Ever wondered how sharp your financial mind really is? Test your knowledge with these 52 best finance riddles and see if you can crack them! Finance riddles are a fun and engaging way to challenge your knowledge about money, investments, banking, and the world of economics. Solving these riddles isn’t just about having fun; it’s also a great way to boost your financial literacy and improve your problem-solving skills. So, are you ready to show off your financial expertise? Let’s get started!

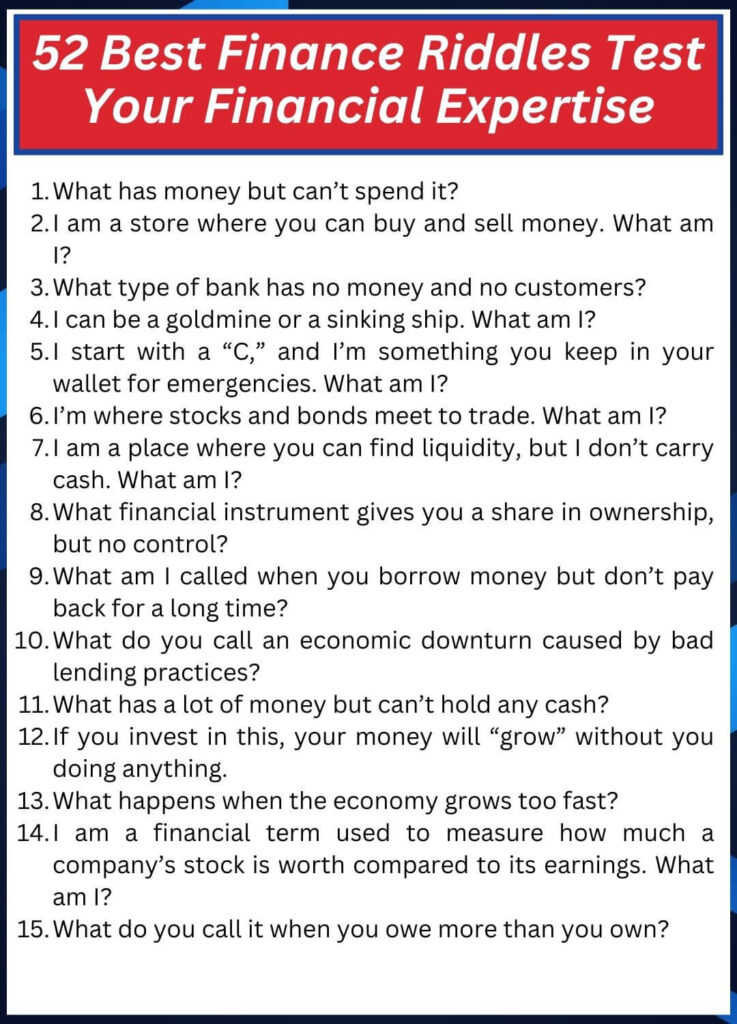

52 Best Finance Riddles

- What has money but can’t spend it?

- I am a store where you can buy and sell money. What am I?

- What type of bank has no money and no customers?

- I can be a goldmine or a sinking ship. What am I?

- I start with a “C,” and I’m something you keep in your wallet for emergencies. What am I?

- I’m where stocks and bonds meet to trade. What am I?

- I am a place where you can find liquidity, but I don’t carry cash. What am I?

- What financial instrument gives you a share in ownership, but no control?

- What am I called when you borrow money but don’t pay back for a long time?

- What do you call an economic downturn caused by bad lending practices?

- What has a lot of money but can’t hold any cash?

- If you invest in this, your money will “grow” without you doing anything.

- What happens when the economy grows too fast?

- I am a financial term used to measure how much a company’s stock is worth compared to its earnings. What am I?

- What do you call it when you owe more than you own?

- I am something you need to get a loan from a bank.

- What financial tool helps protect your investments?

- What financial term refers to the difference between what you earn and what you owe?

- What’s a type of loan where you only pay interest and not the principal amount?

- I am the opposite of a bull market. What am I?

- What’s another term for an investor who bets against the market?

- What do you call it when a company is worth more than its liabilities?

- What do you call a large amount of money in a savings account that’s been untouched for a while?

- I’m a financial product that guarantees a fixed return over time. What am I?

- What do you call it when you invest in multiple different stocks to spread risk?

- I can be an asset or liability depending on how you use me. What am I?

- What do you call a bond that’s considered high-risk but offers higher returns?

- I’m what happens when you sell something for more than you bought it.

- I am the number that helps investors understand if a stock is overvalued.

- What’s a type of savings account that allows for a higher interest rate but has restrictions on access?

- What’s a term used to describe the value of all goods and services produced within a country?

- What do you call it when an economy is operating below its potential output?

- What’s the term for when interest rates go up in order to control inflation?

- I’m a tool used by banks to make their loans and deposits safe. What am I?

- What’s a method of managing risk in a portfolio by holding a mix of assets?

- What do you call a company’s profit after taxes?

- What do you call the rate at which the general level of prices for goods and services rises?

- I’m an investment that provides income but doesn’t require you to sell anything. What am I?

- What is the value of a company’s stock determined by?

- What do you call a bond that’s very safe, but offers lower returns?

- I am a type of financial document that helps you track your income and expenses.

- What term describes the total cost of borrowing money, including interest and fees?

- What is the best strategy for managing a retirement account over time?

- What do you call it when a company buys another company?

- What is the term for using borrowed money to increase potential investment returns?

- I am a part of your salary, but not in cash. What am I?

- What do you call it when a company’s stock price is lower than expected?

- What’s the term for a payment made by an employer to an employee for a job performed?

- What’s a financial term used to describe an increase in a country’s GDP?

- What is the opposite of a credit score?

- What do you call it when the market’s demand exceeds its supply?

- What’s the term for an investment that allows you to buy into a variety of companies at once?

Answers on Best Finance Riddles

- A bank

- A bank

- A digital bank

- A stock market

- Credit card

- Stock exchange

- Money market

- Stock

- A loan

- Recession

- A bank

- A mutual fund

- Inflation

- Price-to-earnings ratio

- Insolvency

- Credit score

- Insurance

- Net worth

- Interest-only loan

- Bear market

- Bear

- Solvency

- Dormant account

- Certificate of Deposit (CD)

- Diversification

- Debt

- Junk bond

- Capital gain

- Price-to-earnings ratio

- High-yield savings account

- Gross Domestic Product (GDP)

- Recession

- Tightening

- Reserve requirements

- Diversification

- Net income

- Inflation rate

- Dividend-paying stock

- Market value

- Treasury bond

- Budget

- APR (Annual Percentage Rate)

- Dollar-cost averaging

- Acquisition

- Leverage

- Benefits

- Bear market

- Salary

- Economic growth

- Debit score

- Shortage

- Exchange-traded fund (ETF)

Conclusion

Well done! You’ve just explored 52 best finance riddles that not only test your knowledge but also challenge you to think deeper about the world of finance. Solving these riddles helps improve financial literacy, which is a key to making better decisions when it comes to investing, saving, and spending. So, whether you’re a seasoned investor or just starting out, keep these riddles in mind as a fun way to sharpen your financial expertise. Remember, the more you engage with these concepts, the smarter your financial decisions will be. Keep learning, keep growing, and keep solving!